Misconduct Everywhere

Trustpilot loudly proclaims its ambition to become “the universal symbol of trust”. In reality, Trustpilot has become a symbol of deceit, defamation, and blackmail. No matter where you look on Trustpilot: you find rot, manipulation, or outright deceit. The entire platform reeks of structural misconduct. This is not the result of a few bad actors or an exploitable loophole. Deception, defamation, and coercion are structurally embedded in Trustpilot’s business model. The platform simply could not function as it does without them.

According to the company website, Trustpilot was founded in Denmark in 2007 by Peter Muhlmann. Today, it operates as an UK public limited company listed on the London Stock Exchange, with a market capitalization of roughly $1 billion today. It maintains operations in the UK, USA, Netherlands, Denmark, Italy, and Germany, where it runs its flagship company review platform. Trustpilot has 975 employees and generates revenues of $210m p.a., and hosts about 250,000 companies and brands on its platform.

In 2023, Muhlmann stepped down as CEO and was replaced by Adrian Blair. That same year, the controversial Zillah Byng-Thorne also entered the picture. Why Trustpilot appointed her as Chair is unclear. Her track record shows 100+ directorships, a short-lived tenure at Future, where a shareholder backlash forced her to step down as CEO following her attempt to raise her compensation from $3m to $40m within just six months. Whether this appointment is about credibility, loose oversight, or mere name recognition is up for interpretation.

Trustpilot allows users to review companies, products, or services on a five-star scale. The platform presents this as a benefit to both consumers and businesses: supporting the former make informed decisions, and the latter to “build trust,” “grow,” and “improve” by listening to customer feedback. It also claims its service is free for both: consumers and businesses. But this raises the obvious question:

How does Trustpilot make money?

The answer is as simple as disturbing: Trustpilot’s business model relies on pressuring businesses into paying for premium services by leveraging negative reviews, often of dubious origin. In other words: Trustpilot profits not from promoting trust, but by fabricating fear and selling the antidote.

Rotten Business Model

Trustpilot operates a value chain that is rotten from top to bottom. Here is how the platform actually operates:

Businesses listed on Trustpilot never consented to being there.

Instead, Trustpilot collects business data from consumers who attempt to write reviews, often without either party’s knowledge. If a company doesn’t yet exist on the platform, it is automatically created. In practice, this means that anyone can add a business to Trustpilot, with no verification of the reviewer or the entity being reviewed.

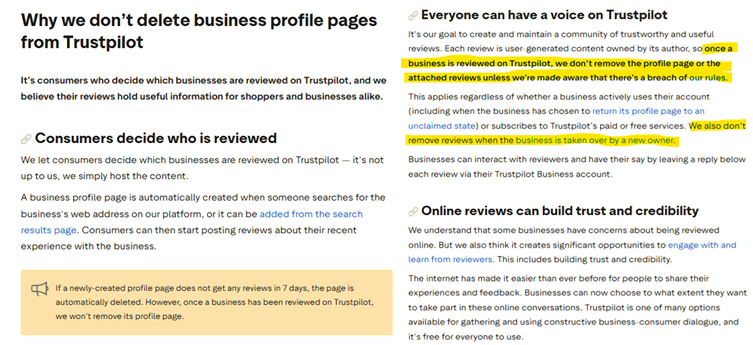

Once listed, a business cannot be removed.

Even if the owner or manager verifies their association with the company, they have no legal right to request removal. The profile becomes a permanent fixture of Trustpilot’s ecosystem, whether it is accurate, authorized, or not.

Attention: The company falsely claims that businesses are removed if one week after being created no review has been placed. This is clearly a lie considering that 50% of all companies on the platform are without a single review and remain undeleted. It appears that not consumers, but Trustpilot itself is generating companies for review on their platform; probably using public court registry publications. Again, all these companies stay on the platform forever, even without reviews.

The trap

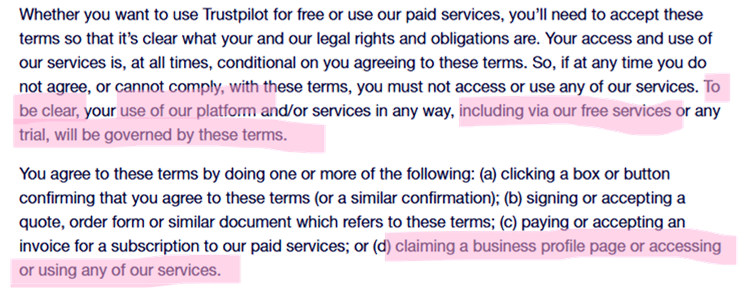

- If the initial review is fake or defamatory, businesses can technically request its removal. However, there’s a catch. In order to file a complaint, the business must first “claim” the profile by registering as an official representative. But in doing so, they must agree to Trustpilot’s terms and conditions, which are deceptive by design.

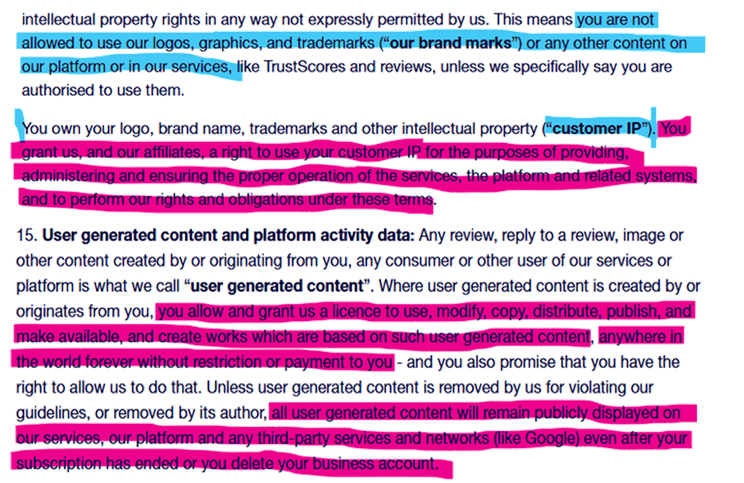

- The terms and conditions are sneaky: Once the terms are accepted, the business grants Trustpilot a blanket license to its intellectual property (IP). Trustpilot claims it needs this IP to operate the platform, yet refuses to delete the company profile under any circumstances. In effect, the license becomes perpetual and non-revocable.

- Worse still, Trustpilot claims a “time-, location-, and content-unlimited right of use” over a business’s intellectual property, effectively giving itself free rein to exploit that content for commercial purposes, indefinitely.

And this is only the onboarding process for what Trustpilot calls its free service (which comes at the cost of giving up your IP), and which makes it impossible for companies to get delisted from the platform.

Once a business has been onboarded, Trustpilot begins aggressively upselling its paid services. These are marketed as tools to “engage with customers,” “learn from feedback,” and other marketing buzzwords. Pricing starts at $200/month for smaller businesses, $1,000+ for mid-sized firms, with undisclosed pricing for enterprise clients.

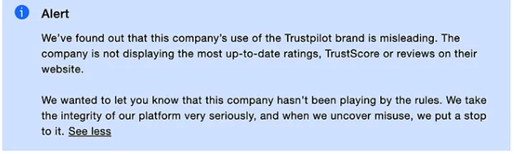

One of the so-called “premium features” is the right to purchase tools that allow companies to display Trustpilot reviews or even just the average star rating on their own websites. If a business declines to use Trustpilot’s tools but still links to its profile, Trustpilot will display a warning to customers, effectively punishing the business for not buying in.

Even more disturbing, some businesses report that positive reviews have been removed, deliberately lowering overall ratings to increase pressure on them to upgrade to a paid plan.

Trustpilot even promotes the ability to filter out low-rated reviews and display only four- and five-star reviews, which can be further “enriched” by manually selected “favorite” ratings. This practice clearly undermines the platform’s supposed mission of transparency and trust.

Fake Reviews

We are now approaching the very core of Trustpilot’s fraudulent business model: the systematic use of fake reviews to create artificially high ratings that bear little resemblance to reality.

This becomes evident when analyzing entire sectors, take banking, for example. The number of reviews per company is highly suspicious. Small, unknown firms often have 20,000 reviews or more, sometimes even exceeding the number of customers they claim to serve. Meanwhile, well-established institutions struggle to reach a few hundred reviews.

It is consistently small, digital-first startups that exhibit disproportionately high numbers of reviews, and strikingly high average ratings. A closer look reveals several red flags:

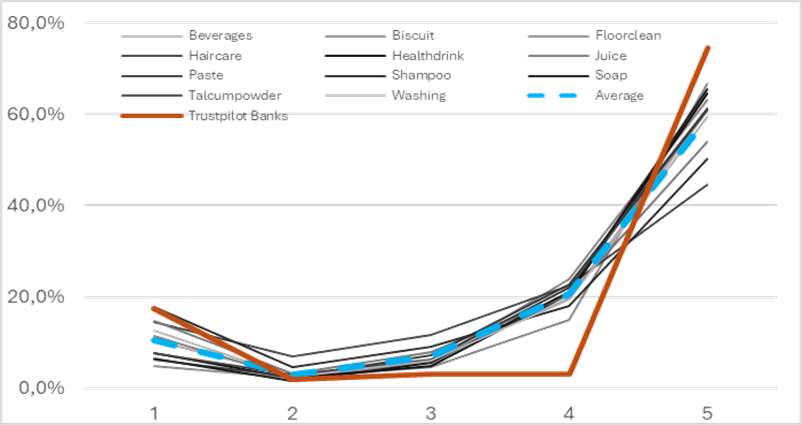

1. Irregular Distribution of Star Ratings

Even the metadata of Trustpilot reviews suggests manipulation. Numerous academic studies on fake review detection have identified typical distribution patterns associated with inauthentic content. Trustpilot’s distributions, however, surpass even those benchmarks in their irregularity.

A glaring sign is the absence of 4-star ratings – a clear indicator that the 5-star ratings are not authentic but artificially manufactured. Another red flag is the distorted ratio of 5-star to 1-star reviews.

2. Clearly Fabricated 5-Star Reviews

To investigate further, we analyzed the 5-star reviews using an AI model designed to assess review authenticity. The model applies several weighted criteria to calculate the likelihood of a review being fake.

| Criterion | Weight | Example (for fake) |

| Emotional balance | +++ | Overly positive, no ambivalence, no frustration |

| Personal context | ++ | No mention of user circumstances, motivations, anecdotes |

| Specificity | ++ | Vague praise or generic features |

| Narrative flow | + | Fragmented or mechanically structured |

| Language realism | + | Artificial idioms, exaggerated fluency, or unnatural polish |

| Orthographic/grammar | + | If errors exist, are they plausible or awkward? |

In the case of a sample set of companies (namely N26, Bitpanda, and Vivid), AI classified more than 80% of their 5-star reviews (based on a sample of 50 reviews each) as likely fake. By contrast, fewer than 5% of the 1-star reviews showed signs of inauthenticity.

This pattern is unsurprising. The motivation to write a 1-star review following a bad experience is significantly stronger than the impulse to leave positive feedback. Moreover, companies aiming to improve their average rating after a wave of negative reviews are unlikely to delete only the bad ones. The more effective method is to flood the system with fake positive reviews.

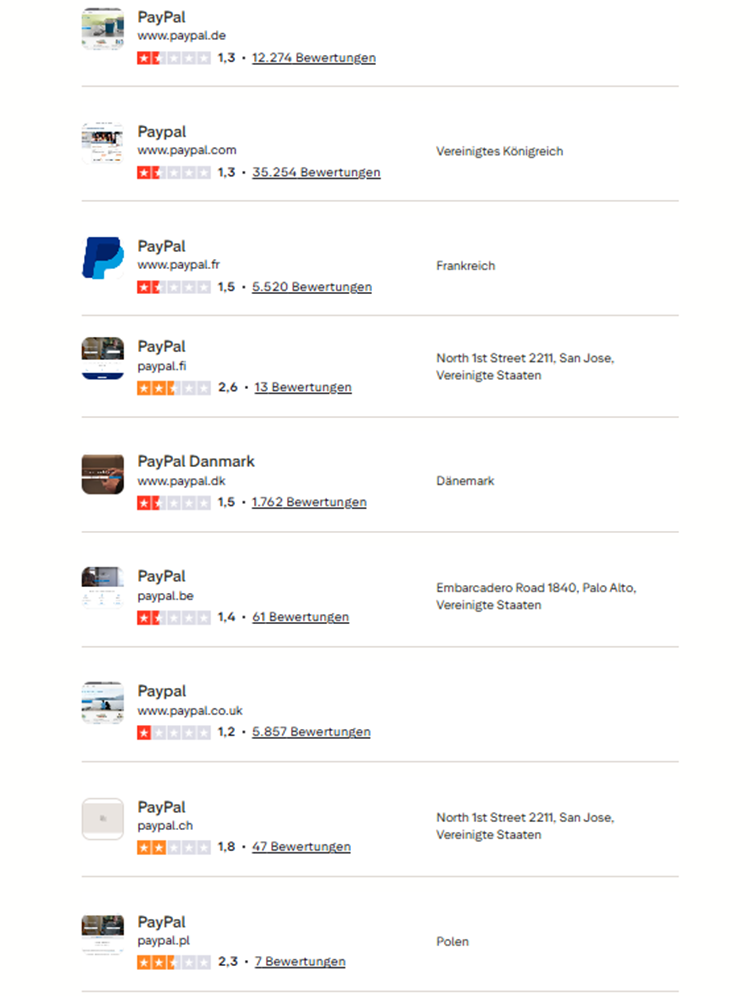

Perhaps the most telling example of how Trustpilot operates is found in the reviews for PayPal. As a global leader in digital payments, PayPal has never partnered with Trustpilot. The result? PayPal stands out with an overall rating of low 1.4 stars across more than 50,000 reviews. A rare and revealing case illustrating Trustpilot’s degree of manipulation with other, paying profiles.

Declining Business Modell

Beyond the deceit built into Trustpilot’s business model, the company’s genuine mission is also under growing pressure. The most serious threat comes from competition with Google, which has steadily taken over Trustpilot’s core markets. Google has offered customer reviews since 2014, but a major algorithm update in November 2023 marked a turning point: business profiles and reviews became more deeply integrated into search results and were displayed more prominently. Since then, Trustpilot’s traffic has been in continuous decline.

The competitive disadvantage is even greater because Google can cross-subsidize its review services. Businesses that claim their profile receive a free dashboard to manage reviews, whereas Trustpilot charges for similar functionality.

The situation worsened further with Google’s rollout of AI-generated answers to customer queries. These summaries already undermine product providers by giving users a comprehensive overview without visiting the provider’s website. The effect is even more damaging for reviews, where Google’s integrated, no-cost solution leaves little reason for users and businesses to turn to Trustpilot.

For this reason, Trustpilot entered into a cooperation agreement with Google – which, in reality, appears to be little more than an advertising contract requiring substantial payments from Trustpilot to Google. Yet this move merely treats the symptoms of Google’s dominance rather than addressing the root problem. It is only a matter of time before Google either cancels the agreement or raises fees to a level that Trustpilot cannot sustain.

Current Financial Report

We do not intend to dwell too much on the unaudited H1/2025 financial report published on 09/16/2025. Still, it deserves mention, as it drew significant attention and triggered a two-day stock rally of 15–20%.

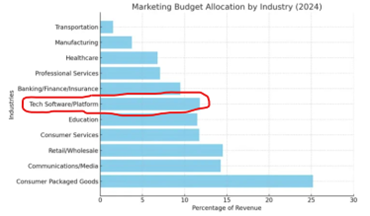

According to the notes to the financial statements, cost of sales consists primarily of expenses for up- and cross-selling to existing customers. This is hardly surprising, given that such activities lie at the core of Trustpilot’s business model. What is questionable, however, is why an online platform records cost of sales at nearly 20% of total revenue. By contrast, sales and marketing is assumed to relate mainly to new customer acquisition (or reviews, which create the entry point for selling Trustpilot’s services) and likely consists largely of commission payments. Together, cost of sales and sales and marketing amount to roughly 45% of revenue. The reached level appears excessive for a digital business. This becomes clearer when contrasted to the following industry averages, where average spendings for tech firms is about 12%.

The marketing and sales position of Trustpilot alone (without cost-of-sales) exceeds all averages according to the Gartner data.

Technical expenditures present another puzzle. At 26% of revenue, or $33m, they dwarf depreciation of just $2.8m. This discrepancy raises the question of where the funds are being spent, as only a small fraction seems to be allocated to software capitalization or equipment replacement, which typically depreciates over three to five years.

A look at liquidity metrics paints a similarly mixed picture. The current ratio stands at 1.11 compared with an industry standard of 1.45, while debt-to-equity is 39.3% versus a benchmark of only 2%. To be fair, this marks an improvement relative to Trustpilot’s five-year average debt-to-equity ratio of 93%.

These debt-related KPIs must be interpreted in light of Trustpilot’s heavy reliance on private equity financing. This also explains the ownership structure: only about 15% of shares are free float, while the rest is spread across some 90 funds and investment firms (including virtually every major name in the investment management sector). Against this backdrop, it comes as little surprise that the publication of the H1/2025 report set the stock rallying in near-frenzy mode.

But said once again: it is not Trustpilot’s financial position that raises our greatest concerns.

Consequences

The real issue is the Trustpilot’s weakening and increasingly unsustainable while fraudulent business model. Hanging over the company is a true sword of Damocles: mounting legal risks with potentially far-reaching consequences. A consortium of US companies is currently challenging the legal validity of Trustpilot’s Terms and Conditions: the illegitimate appropriation of usage rights and the platform’s refusal to delete company profiles upon request by affected business owners.

At the same time, Germany’s Federal Association of Consumer Advice Centers is preparing legal action against Trustpilot for consumer deception, with similar proceedings in other jurisdictions likely to follow.

Given that nearly all of Trustpilot’s $200m in annual revenue is derived from premium services, any successful legal action that undermines this model. Especially disputes with existing clients could prove devastating for the stock. This risk comes on top of the reputational damage that would inevitably follow a formal judgment of misleading consumers. Not to mention the potential frictions this would cause in the partnership with Google.

The irrational surge in Trustpilot’s stock price following the latest H1/2025 financial report creates, in our view, the ideal entry point for a short position. We believe the company has no viable path to long-term survival. More cautious bears may target the 1.59 GBp level.

Beyond Trustpilot itself, we are closely monitoring potential spillover effects. Many companies with suspiciously high volumes of five-star reviews appear to be colluding with Trustpilot, effectively paying for artificially inflated reputations. These firms may soon face regulatory or market scrutiny of their own. A quick glance at the banking sector alone reveals a familiar pattern: names such as Bitpanda, Vivid, Monzo, Starling Bank, bunq, MoneyLion, and others are all young neo-banks that warrant critical examination even without their entanglement with Trustpilot.